Scale your Funded X Prop Firm account with TradeLocker.

Scaling in the FundedX prop firm space can be both exhilarating and challenging. Prop firms, or proprietary trading firms, allow traders to use the firm’s capital to trade, sharing profits while mitigating individual risk.

Leveraging platforms like FundedX and TradeLocker can be a game-changer in achieving significant growth. Here’s a step-by-step guide on how to effectively scale in the prop firm space using these powerful tools:

1. Understand Your Prop Firm’s Value Proposition In order to Scale your FundedX Prop Firm Challenge

Before diving into scaling strategies, it’s crucial to fully grasp the unique advantages that FundedX and TradeLocker bring to the table:

FundedX: Known for its robust funding solutions and tailored support, FundedX offers capital to traders and investors, allowing them to trade with increased leverage while sharing profits with the firm. Their expertise lies in understanding market dynamics and providing customized funding plans that fit individual trading styles and goals.

TradeLocker: This platform excels in trade finance and transaction management. It streamlines the trading process by offering features that simplify trade execution, risk management, and performance tracking. TradeLocker’s technology helps traders optimize their strategies and manage their portfolios more efficiently.

2. Develop a Clear Scaling Strategy

Scaling effectively requires a clear plan. Here’s how to outline your strategy:

Define Your Goals: Determine what scaling means for you. Are you aiming to increase the volume of trades, expand into new markets, or boost overall profitability? Setting specific, measurable goals will guide your strategy.

Assess Your Current Position: Evaluate your current trading performance, capital usage, and risk management. Understanding where you stand will help identify areas for improvement and expansion.

3. Leverage FundedX’s Capital and Expertise

FundedX can be instrumental in scaling by providing additional capital and strategic support:

Access Increased Capital: Use FundedX’s funding to increase your trading size and leverage. This can enhance your ability to execute larger trades and explore more opportunities in the market.

Utilize Strategic Guidance: Take advantage of FundedX’s expertise to refine your trading strategy. Their team can provide insights into market trends, risk management techniques, and optimal trading practices.

Build a Relationship with FundedX: Maintain open communication with FundedX to ensure alignment on trading goals and strategies. A strong partnership can lead to additional support and resources as you scale.

4. Optimize Trading with TradeLocker’s Technology

TradeLocker offers technology solutions that can significantly enhance your trading operations:

Streamline Trade Execution: Use TradeLocker’s advanced tools to automate and optimize trade execution. Efficient trade execution can reduce transaction costs and improve overall performance.

Enhance Risk Management:Implement TradeLocker’s risk management features to monitor and control exposure. Effective risk management is crucial when scaling, as it helps protect against large losses.

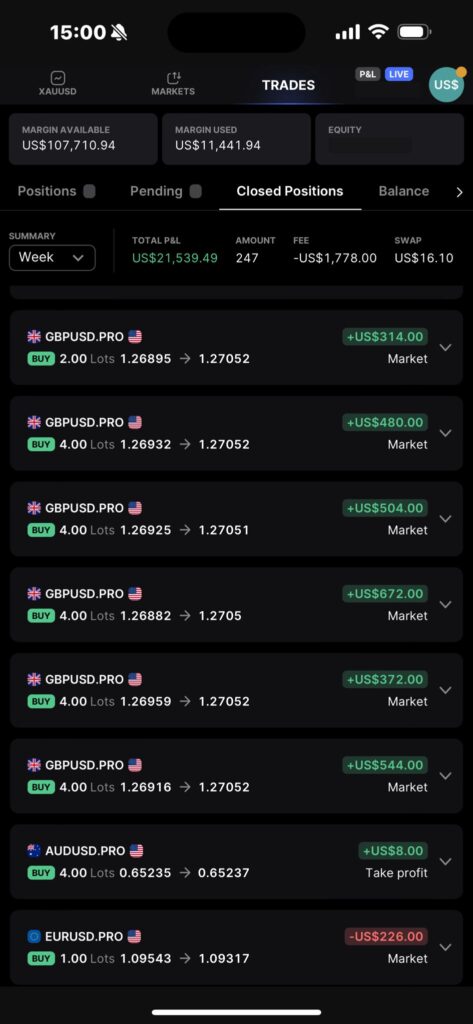

Track Performance:Utilize TradeLocker’s analytics to track your trading performance and identify areas for improvement. Data-driven insights can inform better decision-making and strategy adjustments.

5. Expand and Diversify Your Strategies

As you scale, consider diversifying your trading strategies to mitigate risk and capture new opportunities:

Explore New Markets: Use FundedX’s capital to enter new markets or asset classes. Diversifying your trading portfolio can provide additional revenue streams and reduce dependency on a single market.

Adopt Advanced Strategies: Implement sophisticated trading strategies that leverage your increased capital. This might include algorithmic trading, arbitrage, or high-frequency trading, depending on your expertise and market conditions.

6. Continuously Monitor and Adjust

Scaling is not a one-time effort but an ongoing process:

Monitor Performance Regularly: Keep a close eye on your trading performance and the impact of scaling strategies. Regular monitoring helps identify trends, assess the effectiveness of your strategies, and make necessary adjustments.

Adjust Strategies as Needed: Be prepared to tweak your strategies based on performance data and market conditions. Flexibility and adaptability are key to sustained growth.

7. Foster Collaboration and Networking

Building a network and collaborating with other traders can provide additional insights and opportunities:

Engage with the Trading Community: Participate in forums, attend industry events, and connect with other traders to share knowledge and experiences.

Leverage Partnerships: Collaborate with other traders or firms that complement your strategies and goals. Strategic partnerships can provide additional resources and insights.

Conclusion

Scaling in the prop firm space with FundedX and TradeLocker involves a strategic approach that combines increased capital, advanced technology, and continuous optimization.

By understanding the unique benefits of each platform and implementing a clear scaling strategy, you can maximize growth and achieve significant success in the prop trading world. With careful planning and execution, FundedX and TradeLocker can be powerful allies in your journey toward scaling and thriving in the competitive trading landscape.